By melding premium produce with state-of-the-art technology, the United Kingdom stands as a trailblazer in driving innovation within the food and beverage industry.

Food and drink

The food and beverage industry in the UK holds the distinction of being the nation’s largest manufacturing sector in terms of turnover, with a substantial value of £104.4 billion. Notably, it surpasses the combined worth of the automotive and aerospace industries.

The UK offers abundant prospects for exporters, investors, and international buyers, boasting significant expertise across the entire food and drink supply chain, spanning all phases of product development. The country serves as a robust hub for research and development, marked by well-defined avenues to market, positioning it ideally to meet the evolving demands of consumers.

Opportunity highlights

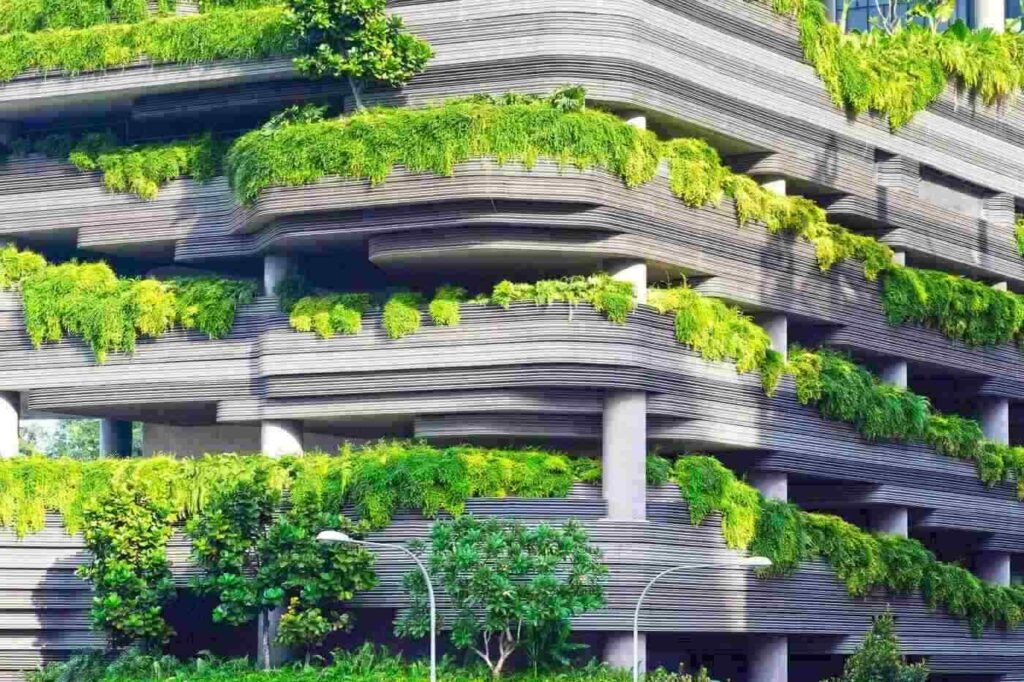

Sustainability and Smart Packaging

The food and beverage industry is witnessing a surging demand for sustainable and environmentally friendly packaging, and the UK offers funding for the development of such products. According to a 2019 YouGov report, 82% of consumers actively aim to reduce their plastic waste, and almost half of them are willing to pay extra for more eco-friendly packaging. The £20 million Made Smarter Innovation programme supports sustainability-enhancing innovations in manufacturing by curbing material wastage and energy consumption.

Functional Food

There is a consistent uptick in the demand for functional foods, which are modified foods claiming to boost health. Consumers are becoming increasingly focused on preventive healthcare and the potential for functional foods to prevent nutrition-related diseases while enhancing both physical health and cognitive function. The global market for functional foods reached a valuation of £209.6 billion in 2021, with a projected compound annual growth rate of 9.5% from 2021 to 2028. The UK stands at the forefront of developing these innovative foods.

Plant-Based and Alternative Protein Sources

The popularity of vegetarian and vegan diets is on the rise, paving the way for exciting developments in the food industry. Manufacturers are actively creating plant-based and alternative protein sources. Frost and Sullivan reported in 2021 that the market revenue for plant protein ingredients is set to reach £16.8 billion by 2026. A significant opportunity in the alternative protein market is the emergence of lab-grown meat. A 2018 Adam Smith Institute report foresees this as a potential multi-billion-dollar industry, with the UK well-positioned to lead the way.

Commercial maturity

The UK has positioned itself as a leader in innovation by harmonizing top-tier produce and technological breakthroughs to meet consumer needs. There is a growing emphasis on sustainable production, reducing environmental footprints, and offering healthier food choices.

The industry has built a strong ethical and global standing, presenting vast opportunities for growth both domestically and on the international stage. This encompasses emerging markets, where premium products are gaining popularity.

UK assets

Food and drink production is a thriving industry across all regions of the UK, with a well-established export capacity that resulted in exports surpassing £23 billion in 2019.

Scotland

Scotland’s bountiful natural resources, coupled with its world-leading technology, foster an industry continually pushing the boundaries of innovation. With a rich history of expertise in distilling, engineering, science, and research, Scotland’s universities, such as Glasgow and Strathclyde, have even developed an artificial tongue capable of discerning subtle differences between whiskies, a breakthrough that aids in combatting counterfeit alcohol trade.

Northern Ireland

Northern Ireland boasts a progressive industry rooted in family farms and fishing enterprises, along with award-winning food and drink producers renowned for their original products. The region possesses high-quality raw materials, state-of-the-art processing facilities, and an exceptional track record in food safety – attributes sought after by major retailers. Moreover, Northern Ireland is home to numerous research centres, including Queen’s University Belfast’s Institute for Global Food Security and Ulster University’s Nutrition Innovation Centre for Food and Health.

Lincolnshire

The demand for robotics to enhance food manufacturing automation is on the rise, and Lincolnshire has a strong research and development infrastructure for this purpose. The Lincoln Institute for Agri-food Technology (LIAT) is a pioneer in this domain, housing the world’s first Centre of Excellence in Agricultural Robotics.

North East of England

The North East of England hosts the UK’s sole 100% dedicated plant-based manufacturing facility in County Durham. Companies like Quorn Foods have established operations in this region, benefitting from cost-effective industrial space and ample research capacity, which facilitates ongoing innovations in the sector.

R&D capability

The United Kingdom offers a robust foundation for research and development in the food and drink sector. The country is home to a diverse array of research universities, and the Food and Drink Federation predicts that we can expect a potential £55.8 billion value added to the industry through the implementation of existing digital technology over the next decade. In 2021, the UK government unveiled its Research and Development Roadmap, outlining its goals to boost public investment in research and development to £22 billion annually by 2024-25. Furthermore, the UK’s top 15 food manufacturers collectively allocate £900 million each year for research and development.

The UK enjoys a well-deserved reputation as a leading innovator in the food and drink industry, particularly in areas such as high-tech packaging, health foods, and convenient food options. According to BDO’s 2021 Food and Drink Report, 77% of food and drink manufacturers have expressed an intent to heighten their focus on new product development and innovation, underscoring the industry’s collective commitment to meeting evolving consumer demands.

Business and government support

The Knowledge Transfer Network (KTN) plays a crucial role in assisting businesses by connecting them with expertise and financial support, leveraging their network of connections encompassing businesses, university resources, and investors.

To stimulate additional research and development efforts, various incentives are extended to companies. The UK government allocates funds to UK Research and Innovation (UKRI), and through Innovate UK, a multitude of funding opportunities is accessible to aid highly innovative small and medium-sized enterprises (SMEs) and large businesses. The financial support available can span from £25,000 to £10 million, contingent on the project’s scope and scale. Companies can also make use of HMRC R&D tax credits and R&D expenditure credits as further incentives for their research and development activities.